It’s been 7 years since business peaked liked this. VCs pumped money in web 2.0 companies in the first half of 2007 – $464.2M in 101 deals worldwide. According to a recent study published by VentureOne and Ernst & Young. This marks the record for a half year in the sector and represents a 7% growth compared to the equivalent period in 2006.

The study confirms what Israeli entrepreneurs have experienced in the last couple of years – Web 2.0 investments are no more exclusive to Silicon Valley as they are quickly migrating and gaining international traction in Europe, Israel and other parts of the US. The interesting thing is that the 14% increase in deals in the first half of 2007 is attributed primarily to investments made in Europe and Israel.

From the report:

The data showed that US$52 million was put to work in 20 European Web 2.0 deals in the first half, roughly double the deals and investments seen in the same period last year. What’s more, Israeli Web 2.0 companies had their best showing to date, raising US$15 million in five deals in the first half, up from two deals and US$5 million invested in all of 2006.

Most of the investments in the first half of the year focused on “Enterprise 2.0” whereas those made in Israel and China had a consumer/ end user focus.

Other interesting facts from the IVC Online report:

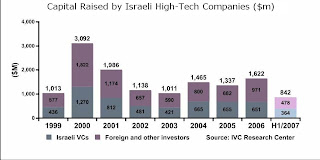

- In the second quarter of 2007, 118 Israeli high-tech companies raised $436 million from venture investors – both local and foreign.

- Israeli startups financed by venture capital racked up $2.5 billion in exits (buyouts or share issues) in the first half of 2007

- Nineteen Seed companies raised $51 million in the second quarter of 2007, attracting

12 percent of capital raised, compared with only $14 million or 3 percent in Q2 2006. - Government support for early stage companies remains high:

- Almost any start-up can qualify for a $200,000 grant.

- The incubator program offers support for entrepreneurs who are relieved of many of the administrative chores.

It’s safe to predict that the investment trend of 2007 will continue to grow and save as a foundation for 2008. I expect to see more and more Israeli exits in the coming year as part of a self fulfilling cycle – more money pours in, more products are shipped> revenue gets generated (hopefully) > more exits > more money pours in. See my previous coverage on this trend here.